Little Known Questions About Personal Debt Collection.

Wiki Article

Our Personal Debt Collection Statements

Table of ContentsThe 4-Minute Rule for International Debt CollectionAll About International Debt CollectionThe smart Trick of International Debt Collection That Nobody is Talking AboutThe Ultimate Guide To Debt Collection Agency

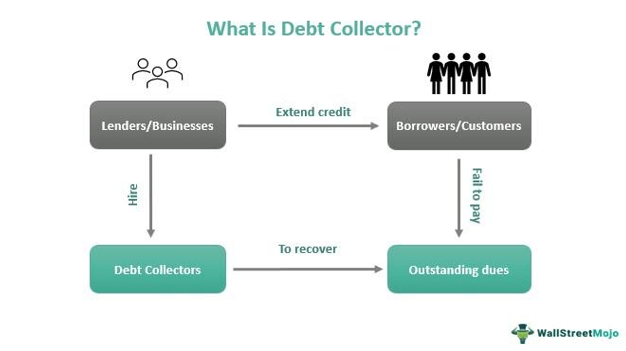

A financial obligation collector is an individual or company that is in business of recovering money owed on overdue accounts - Dental Debt Collection. Many financial obligation collectors are worked with by firms to which money is owed by people, operating for a level cost or for a portion of the quantity they are able to accumulateA financial debt collection agency might also be recognized as a collection company. Below is just how they function. A financial obligation enthusiast attempts to recuperate past-due financial debts owed to lenders. Financial debt collectors are usually paid a portion of any money they take care of to accumulate. Some financial obligation collectors purchase overdue debts from creditors at a discount and after that look for to accumulate on their very own.

Debt enthusiasts that break the rules can be taken legal action against. When a customer defaults on a debt (definition that they have actually stopped working to make one or more required payments), the loan provider or lender may transform their account over to a debt collector or debt collectors. Then the financial obligation is stated to have actually mosted likely to collections.

Past due repayments on bank card equilibriums, phone bills, vehicle financings, energy costs, and also back tax obligations are examples of the delinquent financial obligations that a collector might be tasked with fetching. Some companies have their very own debt collection divisions. The majority of find it much easier to hire a financial obligation enthusiast to go after unpaid financial obligations than to chase the customers themselves.

The 2-Minute Rule for Debt Collection Agency

Financial obligation collection agencies might call the individual's individual as well as job phones, and also appear on their doorstep. They may likewise contact their family, friends, and also neighbors in order to confirm the call info that they have on apply for the person. (Nonetheless, they are not enabled to divulge the reason they are trying to reach them.) In addition, they may mail the borrower late payment notices.m. or after 9 p. m. Nor can they incorrectly declare that a borrower will be apprehended if they fail to pay. Furthermore, a collection agency can not literally damage or threaten a debtor and isn't permitted to take properties without the authorization of a court. The regulation additionally offers debtors certain rights.

Both can remain on credit report reports for as much as 7 years as well as have an unfavorable effect on the person's credit rating score, a huge part of which is based on their payment background. No, the Fair Financial Obligation Collection Practices Act uses only to consumer financial obligations, such as mortgages, charge card, see this site auto loan, student loans, and also medical bills.

About Debt Collection Agency

Since scams are common, taxpayers ought to be cautious of any individual claiming to be functioning on part of the Internal revenue service as well as examine with the Internal revenue service to make certain. Some states have licensing demands for financial obligation collection agencies, while others do not.

A financial debt debt collection agency is a company that serves as intermediaries, collecting consumers' delinquent debtsdebts that go to least 60 days previous dueand remitting them to the original financial institution. Financial obligation collectors usually work for debt-collection firms, though some operate individually. Some are likewise lawyers. Discover more concerning how debt collection agenies and debt collectors function.

Financial debt collectors make money when they recuperate overdue debt. Some collection companies bargain settlements with consumers for less than the amount owed. Extra federal, state, as well as browse around here neighborhood regulations were established in 2020 to safeguard consumers faced with financial obligation issues connected to the pandemic. Financial debt debt collection agency will certainly go after any type of delinquent debt, from past due pupil car loans to unpaid medical bills.

Get This Report on Debt Collection Agency

For instance, a company may gather just overdue debts of a minimum of $200 as well as less than 2 years of ages. A trusted agency will also restrict its work to collecting financial obligations within the law of limitations, which differs by state. Being within the statute of restrictions indicates that the financial obligation is not as well old, as well as the creditor can still pursue it legitimately.A financial debt enthusiast has to count on the debtor to pay as well as can not confiscate an income or reach into a savings account, also if the routing and account numbers are knownunless a judgment is acquired. This indicates the court orders a debtor to repay a specific total up to a specific financial institution.

This judgment permits a collector to begin garnishing earnings and checking account, but the collector must still call the borrower's company and also financial institution to ask for the money. Financial obligation collection agencies also get in touch with delinquent debtors that already have judgments against them. Also when a financial institution wins a judgment, it can be challenging to gather the money.

When the initial lender determines that it is unlikely to collect, it will reduce its losses by offering that debt to a financial debt purchaser. Financial institutions bundle numerous accounts together with comparable functions as well as market them en masse. Financial debt buyers can pick from plans that: Are relatively new, without any various other third-party collection activity, Older accounts that collectors have fallen short to collect on, Accounts that fall somewhere in between Debt customers commonly acquire these packages through a bidding procedure, paying typically 4 cents for every $1 of financial obligation stated value.

Report this wiki page